A well-known American best seller has published a particularly interesting formula. In fact, James Clear, in his Atomic Habits, points out that by improving just 1% a day in a certain skill, after a year, we will be about 37 times better at it! It seems absurd, right?

Yet, these are not imaginary numbers. The calculation derives from a very precise and reliable mathematical formula, which we will explore further below. Therefore, on a theoretical level, we could also translate the formula into the financial world. But is it realistically possible to get 1% daily return in crypto and financial markets? Let’s find out together.

Why Calculating Daily Return is not Simple?

The problem lies in the composition of returns. When it comes to financial investments, returns do not add up linearly.

Let’s take a time frame of one year as a reference. A 1% daily return per day, if reinvested every day, will generate an overall return greater than 1% x 365 days. This is because the next day’s gain is calculated on the capital increased by the previous day’s gain. This phenomenon is known as compound interest, which we have discussed extensively in our dedicated article. Let’s do two calculations!

To get a rough idea of the annual return needed, we could use the following formula:

(1 + daily rate)^number of days = annual rate

In our case:

- Daily rate = 1% = 0.01

- Number of days = 365

So, here we are back to the formula mentioned at the beginning:

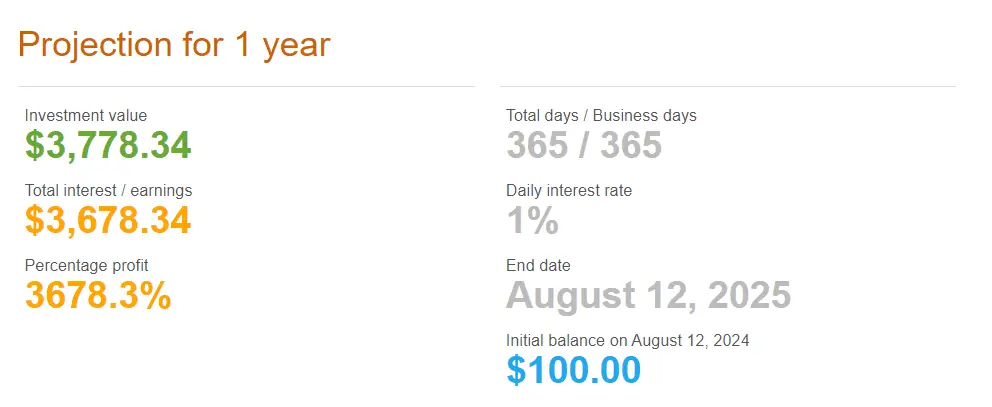

(1 + 0.01)^365 ≈ 37.78

This means that to obtain an average of 1% daily return, we should have an annual return of about 3778%.

The estimate is very high because, as we said, returns are composed in a non-linear way. A constant daily growth rate leads to exponential growth in the long term.

Markets considered risky, that is, those where company shares are listed, have significantly lower performances! The Nasdaq, for example, until the time of writing has performed at an average of about 9-10% per year.

We can also avoid mentioning the performances of low-risk markets, whose annual performances do not even reach double-digit percentages. For the passive and defensive investor, this could be the end of the reading. But let’s try to reinterpret the question and analyze the cases in which it would be possible to obtain 1% daily return per day.

Scenarios Where 1% Daily Return is Achievable

Let’s introduce the other large macro category of operators on the market: traders. These tend to operate on small time frames and shorter time periods than investors. It is not uncommon for even liquid and capitalized markets to close the day with a movement greater than 1%. The good (or lucky) trader may have hit the right trade and taken home a return of 1% daily return or more.

However, traders do not tend to allocate all their capital within a single trade, and obviously, not all trades are profitable, and it is important to never confuse luck with probabilities. In the long run, the probabilities always win out. Hence, the probability of earning 1% per day in the stock market is very low.

So, in a short time frame, it is possible that they manage to achieve a result equal to or greater than 1%, but in the long term, the stop losses deteriorate the final result, which in all probability does not come close to the final 3778% we talked about. The main active funds, equipped with professional traders and attentive analysts who manage to beat the market, collect a few percentage points more than the reference market.

Furthermore, we should contextualize the question better: on what calculation basis do we want to calculate 1%? On our entire capital, on the capital allocated to trading, on the capital allocated to the single trade? The question presents us with many “it depends”. Therefore, we will never be able to respond precisely to such a generic answer, but to satisfy the curiosity of all readers, we will try to contextualize as many scenarios as possible.

Useful Tools for Aiming for a 1% Daily Return

If the market volatility is not sufficient, traders have a tool as powerful as it is dangerous: financial leverage. Through financial leverage, traders can use their liquidity as collateral in order to borrow more and insert it into the same trade. This multiplies the final result, both positively and negatively. In a micro category of traders, we find scalpers. Scalpers are traders who operate at very low time frames, and the duration of the trades is a few seconds or minutes. Clearly, the movement is limited in percentage terms as the trade lasts a few seconds, so they are forced to use very high financial leverage. The financial leverage multiplies the result, so 1% daily return is really a paltry result! But even in this case, the scalper trader will not use his entire capital. So, even in this case, it is not difficult to obtain a 1% daily return in a day, but it will be impossible to do so sustainably for a prolonged period of time! Furthermore, as mentioned earlier, this 1% will be achieved on the capital allocated to that particular trade. With a super positive performance, we could reach 1% of the capital dedicated to trading, but it is unlikely that with a scalp you can take home 1% on the entire capital. Let’s take an example: Alex has a capital of $1,000, decides to use $100 to trade on the markets, and diligently decides to use €10 for each trade. With the first scalp, Alex earns $1, a fantastic 10% in a day! However, if calculated on the capital allocated to trading, the performance drops to 1% (on $100). If we even consider his entire assets, the performance drops to a 0.1% daily return (on $1000).

Now that we have given some context and understood how difficult, almost impossible, it is to obtain 1% daily return per day for long periods of time and in a sustainable way, let’s list some suggestions in order to maximize performance, always remembering that a high return often equates to a high risk. What you will read in a moment is written only for educational purposes.

High Concentration, Little Diversification

Concentrating the portfolio around a certain asset allows us to expose our liquidity exclusively to the performance of that certain asset. This means that the performance of the asset will reflect the performance of our portfolio, positively and negatively. Obviously, the choice of the asset must not be random, but based on specific subjective certainties that that asset can guarantee good performances.

The diversification offered by indices such as the SP500 or the NASDAQ allows us to reduce the risk linked to the performance of a single stock. In this way, the impact of a possible decline in a single asset is cushioned by the positive or less negative performance of other securities in the index, but at the same time, the positive performance is also diluted, not significantly impacting the overall performance of the index.

The second point is closely linked to the first. We certainly cannot concentrate all our capital on a company or asset chosen at random! It will be essential to identify promising assets, discounted and ignored at that time by investors. If we want to obtain extraordinary performances, we certainly cannot choose in the bond market, but we should look for an asset within risky markets.

A Bit of Healthy Madness: Hint at Degen Farming Strategies in Cryptocurrencies

Here, speaking of risky markets. What market is riskier than cryptocurrencies? If we limit ourselves to the first in the class, we expose ourselves to very significant volatility. It is not uncommon for Bitcoin to double or halve its capitalization in a matter of months, and if this is true for Bitcoin, the issue is equally real for the so-called “Altcoins“, that is, all the other cryptocurrencies on the market. Ethereum and Solana are two of the main Altcoins, and despite being well-established and capitalized, they certainly do not exempt themselves from being extremely volatile. With a little rationality mixed with a pinch of pure madness, we can give ourselves exceptional performances with the main Altcoins. Solana, for example, reached a minimum of 8 dollars during the collapse of FTX; despite everything, the on-chain metrics did not present any alarms, and everything continued to work as it always has. Those who had the lucidity to rationally analyze the situation and those who had the healthy madness to buy an asset that was plummeting from $200 to $8, today boast an extraordinary performance. Just a year later, SOL was trading at around $100; a year and 3 months later, SOL hit $200. That’s not even close to 3778%, but we can’t complain, right?

We often hear about the theory of efficient markets, and in fact, markets are. But not always. There are and always have been periods in which markets behave inefficiently, and it is in these periods that the good investor finds opportunities. As Benjamin Graham said, “The intelligent investor is the one who buys from pessimists and sells to optimists”.

Cryptocurrencies, like the tickers of publicly traded companies, are not little symbols that go up and down on a chart but have a foundation on which they are based! With cryptocurrencies, a particular practice has spread, unique in its kind: Farming! Simply put, it consists of providing your own equipment to the service of third-party infrastructures, which are used to perform a service and recognize rewards to the liquidity provider. New protocols often offer high rewards in order to attract new liquidity providers, and the professional farmer could maximize the yield of his portfolio thanks to this practice. Clearly, the purpose of the article is not to focus on cryptocurrency farming, so we also gloss over the risks, which are not few.

Case Study to Avoid: Ponzi Schemes

Sometimes, behind high returns, there are very dangerous fraudulent schemes. This is the case of Ponzi schemes, which promise miraculous but obviously unsustainable returns.

The first people involved can obtain economic returns in a short time, where they facilitate access to the scheme for new customers. The first earnings, in fact, derive from the shares paid by new investors. The fraudulent model remains sustainable as long as new investors enter the scheme, but it will explode when the requests for withdrawals from the system exceed the new payments, making it impossible to maintain the fraudulent system without new flows of money. If someone finds analogies with the Italian pension system, well, they are right.

Conclusions: Is It Possible to Get 1% Daily Return in Crypto and Financial Markets?

We have reached the conclusions of this article. We have contextualized the question, and we have learned that it is not difficult to obtain 1% daily return in a day, but it is impossible to obtain it for a prolonged period of time. To prevent you from saying goodbye to your dreams of glory, we also have some useful strategies for those who wish to snatch percentage points from the market. Now, the final decision is always up to you, dear investor, to understand your risk tolerance and appetite in investing and decide what kind of result you want to aim for. Whatever path you want to take, we at The Fin Zen will guide you with passion and sincerity.